TX Mineral Royalty Interest Deed free printable template

Show details

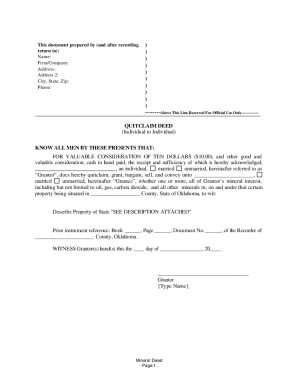

MINERAL AND ROYALTY INTEREST DEED STATE OF TEXAS COUNTY OF KNOW ALL BY THESE PRESENTS That of County hereinafter called Grantor whether one or more for and in consideration of the sum of Ten Dollars 10. TO HAVE AND TO HOLD the above described interest in the oil gas sulphur and other minerals and all other rights herein granted all and singular unto said Grantee or heirs successors and assigns of Grantee forever and Grantor does hereby bind himself and his and/or herself and her as the case...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mineral deed form

Edit your mineral deed pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas royalty interest form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

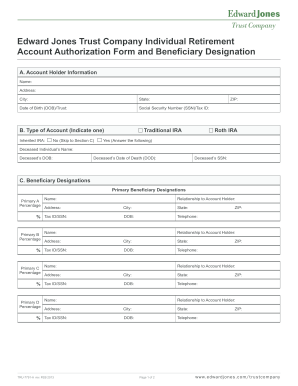

Editing texas royalty interest online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit texas mineral rights deed transfer form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

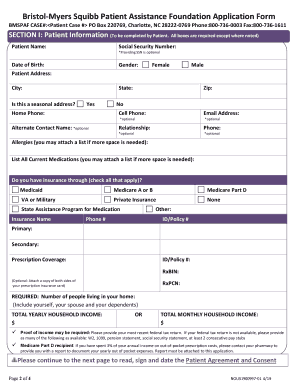

How to fill out mineral rights deed transfer form

How to fill out TX Mineral Royalty Interest Deed

01

Begin by obtaining a TX Mineral Royalty Interest Deed form from a reliable source.

02

Fill in the names of the parties involved, including the grantor (seller) and grantee (buyer).

03

Specify the property description, ensuring it includes the exact location and legal description of the mineral rights involved.

04

Clearly state the percentage of mineral royalty interest being conveyed to the grantee.

05

Include the date of execution for the deed.

06

Sign the deed in front of a notary public to ensure its legality.

07

Record the executed deed with the appropriate county clerk or land office to make it official.

Who needs TX Mineral Royalty Interest Deed?

01

Individuals or entities that own mineral rights and want to sell or transfer a portion of those rights.

02

Investors looking to acquire mineral royalty interests for financial gains.

03

Estate planners who need to allocate mineral rights to heirs or beneficiaries.

04

Landowners with mineral rights who wish to formalize agreements with companies for oil, gas, or mineral production.

Fill

tx royalty deed

: Try Risk Free

People Also Ask about how to fill out tx mineral royalty interest deed gas or mineral production

How do I transfer mineral rights in Ohio?

However, several steps need to be taken to claim mineral rights in Ohio, they include; After confirming your ownership with a lawyer, you should draw up a deed of transfer of the dormant mineral in your name and file it with your local county records office as the new mineral owner ing to the state laws.

Do mineral rights expire in North Dakota?

Any mineral interest is, if unused for a period of twenty years immediately preceding the first publication of the notice required by section 38-18.1-06, deemed to be abandoned, unless a statement of claim is recorded in ance with section 38-18.1-04.

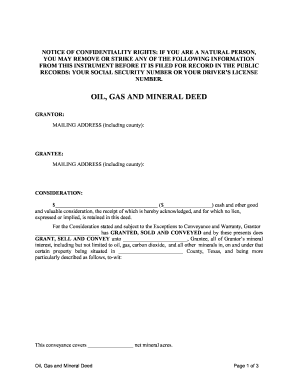

How do I transfer ownership of mineral rights in Texas?

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording. They usually go to the same agency that records titles and property deeds. The county will return the recorded original documents to the new owner.

How do I transfer inherited mineral rights?

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

What is the difference between mineral acres and royalty acres?

Net mineral and net royalty acres define different terms. Net mineral acres define an interest in land, but cannot be equated to dollars and cents. Net royalty acres are much more commonly used in mineral lease transactions because they can fully illustrate the royalty potential of a plot of land.

What is the difference between a mineral deed and a royalty deed?

A mineral deed is less restrictive and grants more rights over the mineral interest than a royalty deed. The second distinction between these types of deed has to do with the size of the financial stake. The mineral deed holder receives a higher reward but at the cost of higher risk.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mineral deed transfer form texas from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your mineral deed into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit texas mineral and royalty deed form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign tx mineral deed online on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete texas royalty interest deed on an Android device?

Use the pdfFiller mobile app and complete your texas mineral royalty deed and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is TX Mineral Royalty Interest Deed?

The TX Mineral Royalty Interest Deed is a legal document that establishes the rights to receive royalties from mineral extraction activities on a specific property in Texas.

Who is required to file TX Mineral Royalty Interest Deed?

Individuals or entities holding a mineral royalty interest in Texas are required to file the TX Mineral Royalty Interest Deed to formally document their entitlement to royalties.

How to fill out TX Mineral Royalty Interest Deed?

To fill out the TX Mineral Royalty Interest Deed, include the legal description of the property, the names of the parties involved, the specific royalty interest percentage, and any relevant dates or additional provisions.

What is the purpose of TX Mineral Royalty Interest Deed?

The purpose of the TX Mineral Royalty Interest Deed is to legally document and clarify the entitlements of mineral rights owners to receive payments from mineral extraction activities on their property.

What information must be reported on TX Mineral Royalty Interest Deed?

The TX Mineral Royalty Interest Deed must report the property description, names and addresses of the royalty interest holders, the percentage of the royalty interest, and any pertinent conditions or stipulations.

Fill out your TX Mineral Royalty Interest Deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tx Mineral Deed Form is not the form you're looking for?Search for another form here.

Keywords relevant to mineral deed form texas

Related to mineral rights deed transfer form texas

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.